In this analysis we will jump into the UK kitchen industry. We will explore Howden Joinery, a company that stands out with his unique business model with solid loyalty effect and ROICs above 25%.

As the undisputed leader in its sector, Howdens commands approximately 30% market share, a figure that continues to expand over time, underpinned by its sustainable and increasingly significant competitive advantages.

I have estimated a share price of ~£15.50 by 2030 on a conservative basis with plenty of optionality for the long term.

Introduction:

Howdens is a UK kitchen supplier specialist serving in the Repair, Maintenance and Improvement Residential market. Its operating model allows it to increase market share 𝐨𝐯𝐞𝐫 𝐭𝐢𝐦𝐞 (currently above 𝟑𝟎%) while generating the highest return and assuming the least risk.

Business Model:

The hearth of its strategy is that they 𝗼𝗻𝗹𝘆 sell to the 𝗽𝗿𝗼𝗳𝗲𝘀𝘀𝗶𝗼𝗻𝗮𝗹 𝗯𝘂𝗶𝗹𝗱𝗲𝗿. By operating this way, Howdens can build on repeat purchases and long-lasting relationship with builders. By contrast, the retail kitchen market typically sells to a customer once every 15 years or so. 𝗡𝗼 𝗼𝘁𝗵𝗲𝗿 𝗽𝗹𝗮𝘆𝗲𝗿 𝗵𝗮𝘀 𝘁𝗵𝗶𝘀 𝗯𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗺𝗼𝗱𝗲𝗹.

Serving the builder is the most intelligent move in this industry because each builder brings dozens or even hundreds of new customers through a long period of time, minimizing the customer acquisition cost and make everything more efficient, creating strong 𝗹𝗼𝘆𝗮𝗹𝘁𝘆 𝗲𝗳𝗳𝗲𝗰𝘁𝘀.

But what makes a builder happy? And the answer, as always, are incentives! Let’s first understand the needs of a typical builder:

The builder aims to earn profits and establish a good reputation by ensuring every project is of high-quality, completed on time, and within budget.

To achieve the objectives, the builder must be able to rely on having truly local stock of everything he needs, from cabinets and ovens to screws and glue.

Time is money so he can’t afford to waste time returning things and everything he buys must also be capable of being fitted quickly and accurately.

Howdens aims to help the builder 𝘀𝗮𝘃𝗲 𝘁𝗶𝗺𝗲 𝗮𝗻𝗱 𝗺𝗮𝗸𝗲 𝗺𝗼𝗻𝗲𝘆 by offering the following:

Great product range with 𝗵𝗶𝗴𝗵 𝘀𝘁𝗼𝗰𝗸 𝗮𝘃𝗮𝗶𝗹𝗮𝗯𝗶𝗹𝗶𝘁𝘆. The customer can get everything in one stop shop.

𝗩𝗲𝗿𝘆 𝗰𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝘃𝗲 𝗽𝗿𝗶𝗰𝗲𝘀 and 𝟴 𝘄𝗲𝗲𝗸𝘀 𝗼𝗳 𝗰𝗿𝗲𝗱𝗶𝘁 𝘁𝗲𝗿𝗺𝘀

Howdens sells pre-assembled cabinets, increasingly with pre-fitted elements, 𝘀𝗮𝘃𝗶𝗻𝗴 𝘁𝗶𝗺𝗲 to the builder (hours or even days).

A typical Howdens depot is on an edge-of-town location - more 𝗰𝗼𝗻𝘃𝗲𝗻𝗶𝗲𝗻𝘁 for the builder, and cheaper to rent. Around 85% of UK customers live within 5 miles (8Km) of a Howdens depot.

A Howden’s designer will visit the customer’s house free of charge to make sure that everything will be fit properly, giving 𝗽𝗲𝗮𝗰𝗲 𝗼𝗳 𝗺𝗶𝗻𝗱 to the builder.

Operations:

Howdens has a reputation for offering lower prices than the competition. The secret lies on its 𝘀𝗰𝗮𝗹𝗲.

It designs and manufactures all its cabinets and some worktops and skirting boards. We are talking big numbers here, around 𝟱 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 𝗰𝗮𝗯𝗶𝗻𝗲𝘁𝘀 in 2022.

The company produce roughly 𝟯𝟱% of what they sell and they plan to reach up to 𝟱𝟬%. Howdens has high bargaining power with over 200 suppliers due to its bulk purchases. The company sells more than 1m appliances, 700k sinks and taps, 2.5m doors and about 4 million m2 flooring.

This scale is massive in the UK. No other competitor come close to it, and this is precisely why they beat everyone in price.

Distribution:

It has a big network of 840 depots in the UK and 75 in other European countries (68 in France, 5 in Ireland and 2 in Belgium). All leased and managed by 𝗲𝗻𝘁𝗿𝗲𝗽𝗿𝗲𝗻𝗲𝘂𝗿𝗶𝗮𝗹 𝗲𝗺𝗽𝗹𝗼𝘆𝗲𝗲𝘀. Managers run their depots as they think best as per their local conditions, with incentives tied to profit and margins.

The company has their own warehouses and distribution operations with trucks delivering to Howdens depots only. In the past, the company used to run weekly deliveries. However, they recently added 𝗡𝗲𝘅𝘁 𝗗𝗮𝘆 deliveries using third party infrastructure.

This new system combined with scale offers a 𝗯𝗶𝗴 𝗺𝗼𝗮𝘁 as it is hard to get copied by other players. This will reduce the stock of low rotation products at depot level and gives more accurate information flows to the manufacturing plants, which then translates into a more efficient use of the production infrastructure, lower costs, and the possibility to introduce new products more effectively.

Industry:

The UK has a market size of about £11.5Bn. This is divided in 𝗞𝗶𝘁𝗰𝗵𝗲𝗻-𝗼𝗻𝗹𝘆 market of about £7Bn and 𝐎𝐭𝐡𝐞𝐫 𝐜𝐚𝐭𝐞𝐠𝐨𝐫𝐢𝐞𝐬 (such as appliances, sinks, doors, flooring and so on) of £4.50Bn.

The Kitchen-only market is further divided in three categories:

1) 𝐄𝐧𝐭𝐫𝐲 𝐥𝐞𝐯𝐞𝐥 – market of £1.6Bn: Kitchens with a ranging price up to £4k.

2) 𝐌𝐢𝐝-𝐫𝐚𝐧𝐠𝐞𝐬 – market of £3.15Bn: Prices between £4-8k.

3) 𝐇𝐢𝐠𝐡𝐞𝐫 𝐩𝐫𝐢𝐜𝐞 – market of £2.25Bn: Prices over +£8k.

Most of Howden’s revenue comes from the “Entry Level” market. I estimate a market share way above 𝟓𝟎% in this segment.

The business is now focusing on gaining market share on the “Mid-ranges” where they are 𝐮𝐧𝐝𝐞𝐫-𝐫𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐞𝐝. The management believes that they can increase total depots from 840 to 1000 in the UK.

The Kitchen-only market is expected to grow 𝟑.𝟐% CAGR from 2023 to 2027. Some drivers are:

Ageing UK housing stock will drive renovation - (Ave. age of UK stock is 𝟕𝟎 𝐲𝐞𝐚𝐫𝐬).

Hybrid working leads to increased wear and tear in the home and most of the time is spent in the kitchen area.

When house prices are high, people are less likely to move and more likely to spend money on improving or renovating their current home:

Competition analysis:

Kitchens are 𝐜𝐨𝐦𝐦𝐨𝐝𝐢𝐭𝐢𝐳𝐞𝐝 𝐩𝐫𝐨𝐝𝐮𝐜𝐭𝐬. The company offering the cheapest price at a similar quality has the upper hand.

This is a high fragmented industry. There are over 5.000 small independent kitchen retailers in the UK today. We can see below some financial comparison against 4 competitors.

The biggest competitor is Wren Kitchens, which sells directly to end customers. Its total Revenue represented just 14% of Howden’s in 2013 but it managed to increase to 50% in 2022.

However, Howdens usually beats Wren for as much as £500-£700 per kitchen (on a similar range and size) and 𝐬𝐭𝐢𝐥𝐥 generating superior margins. This is a signficant discount of 15-20% for virtually the same product.

No doubt that Wren deserves a lot of credit. I believe its key ingredient is that their stores are in expensive areas, close to 𝐬𝐡𝐨𝐩𝐩𝐢𝐧𝐠 𝐜𝐞𝐧𝐭𝐫𝐞𝐬, making them noticeable to the retail customer.

With the implementation of “Next Day Delivery”, Howdens will open smaller depots closer to 𝐜𝐢𝐭𝐲 𝐜𝐞𝐧𝐭𝐫𝐞𝐬 𝐚𝐫𝐞𝐚𝐬. This should increase the end consumer awareness and help builders to gain market in these hard-to-reach places.

Lastly, Howdens has been investing through web advertisement. The website had 1.2m visits in December 2023 compared to just 796k of Wren.

KPIs:

The two key metrics to follow-up the performance of the business are 𝐑𝐞𝐯𝐞𝐧𝐮𝐞 𝐩𝐞𝐫 𝐃𝐞𝐩𝐨𝐭 and 𝐄𝐁𝐈𝐓 𝐩𝐞𝐫 𝐃𝐞𝐩𝐨𝐭. Both have healthy positive trends and I believe it can keep increasing for a long time. EBIT per Depot has a 𝐡𝐢𝐠𝐡𝐞𝐫 𝐠𝐫𝐨𝐰𝐭𝐡, showing economies of scale at work.

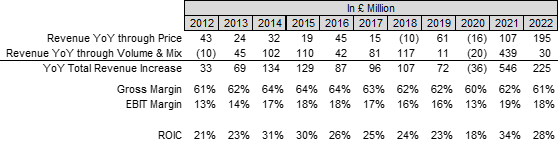

The table below shows stable gross margins above 60%, EBIT margins of 17% and ROIC north of 25%. Most importantly, much of the revenue variation comes from 𝐕𝐨𝐥𝐮𝐦𝐞 𝐚𝐧𝐝 𝐌𝐢𝐱. In 2021, Volume & Mix increased total revenue by £𝟒𝟑𝟗𝐦 and it was able to maintain it in 2022, plus an extra £30m.

This is a 𝐫𝐞𝐬𝐢𝐥𝐢𝐞𝐧𝐭 business barely affected in 2009 and 2020:

Competitive Advantages

Low-Cost Operations:

Howdens cost structure cannot be matched by any other player in the business. It is the biggest player by far and it keeps improving its distribution system which will translate into lower costs, higher stock availability and higher market share.

Loyalty Effects

It maintains relationships with roughly 500k builders in the UK (~𝟑𝟑% of all independent builders). A happy builder is likely to make 𝐫𝐞𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 sales over a 𝐥𝐨𝐧𝐠 𝐩𝐞𝐫𝐢𝐨𝐝 𝐨𝐟 𝐭𝐢𝐦𝐞. This then helps Howdens to get more scale which means lower costs and more stock availability, reinforcing the loop all over again.

Builders also offer feedback to Howdens about the latest styles from the end-consumer. This gives 𝐠𝐨𝐨𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 to launch new ranges and products.

For a competitor to inflict damage, it will need to invest heavily on manufacturing assets to match the cost structure. It will also have to get hundreds of depots and then it would have to operate at a loss by several years to be able to attract builders from Howdens.

Culture:

Howdens maintains a decentralized system where sale decisions are taken at local level. This enables it to adapt and gain market share by addressing each community on a standalone basis.

It ranked 𝟏𝟎𝐭𝐡 in the top 100 UK's Best Big Companies to Work-For in 2021 (15th in 2020).

In words of the CEO, Andrew Livingston

“Ultimately, it comes to this. The builder is our brand. Our job is to resource the builder, and to resource our staff, so that they can help the builder in the best way they can”.

Anti-Amazon:

By its nature, kitchen design and installation is a 𝐬𝐞𝐫𝐯𝐢𝐜𝐞-𝐢𝐧𝐭𝐞𝐧𝐬𝐢𝐯𝐞 business that is tough for an online competitor to break into. Given the intricacies of the business, the supplier needs to offer design solutions and keep communications with the contractor installing the kitchen. If not, there’s a high likelihood the kitchen equipment won’t fit correctly.

Technological change:

It is worth mentioning that there are no technological risks in this industry. Kitchens will continue to be used the same way they are used today. On the contrary, new modern equipment and designs will increase owner’s expenditures going forward.

Growth in France

The management is expanding in France, a €𝟒.𝟑𝐁𝐧 Kitchen-only market. I believe this could be a great source of value for the next decade because of the following leverage points:

𝟗𝟎% of products are 𝐜𝐨𝐦𝐦𝐨𝐧 with UK range. This will allow scale benefits. The idea is that Howdens will use the UK infrastructure to serve this market. The best part is that this growth 𝐝𝐨𝐞𝐬𝐧’𝐭 𝐧𝐞𝐞𝐝 𝐞𝐱𝐭𝐫𝐚 𝐜𝐚𝐩𝐞𝐱 𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭. The production assets can support the whole French market because peak periods between UK and France are 𝐝𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐭.

Gross margins in France are ~65% and transports costs are the same as some areas of UK.

The market has low penetration rates of integrated kitchens, and most are purchased through DIY outlets and small independent business. This leaves plenty of opportunity for Howdens to grow and generate value to builders, just like it did in the UK when it was founded.

Howdens has a current market share of about 𝟏%.

Management:

Its current CEO is Andrew Livingston who joined in 2018. He comes from Screwfix Direct Ltd, a home improvement company with over 1400 stores, where he previously held the position of Commercial and Ecommerce Director.

Management is financially incentivized. They get an annual bonus equivalent of up to 200% its salary. At least 30% of the bonus is paid in shares and vests over two years. The metrics to assess the bonus are:

60% Profit before taxes

20% Total Shareholder return.

10% Return on Capital Employed.

10% Environmental measures.

Executive Directors are expected to build up and maintain a personal shareholding in the Company of at least 200% of salary. Andrew has exceeded this minimum threshold by holding 263% of salary as of 31 December 2022.

Capital allocation is simple. Dividends are usually 25-30% of total earnings. All remaining cash above £250m is allocated to buybacks. My concern is that these purchases are made without any strategy at all, just to give back the cash. Fortunately, the stock generally trades at decent multiples.

Valuation:

For my initial valuation, I excluded international growth and assumed that they will reach 1000 depots in the UK by 2028 (opening 33 new depots per year. They opened 33 and 30 in 2022 and 2021).

I’m projecting flat revenue for 2023 but then an annual average increase of 5% up to 2030. This implies a kitchen-only market share of ~𝟑𝟖% (up from ~30%).

Using conservative EBIT Margins of 17% and ROIC of 24.50% in line with the past, Revenue per Depot and EBIT per Depot would be as follow:

Regarding capex, the management has been in investment mode to gain market share in the Mid-Range market. I estimate that they will invest ~£90m annually for the next 6 years. By the year 2028, the business will have all required machinery to produce 50% of what they sell, 1000 UK depots and all depots revamped to support the new distribution system.

From this point forward, Howdens will start to accumulate big amounts of FCF, about £400m per year. The stock has traded around 20x FCF/Share during the last 5 years. Given that future growth will be lower, I contracted this multiple to x17 to be conservative resulting in a stock price of £13 by 2030.

I also believe the management would be able to buy back at least 15% of the company by 2030, this could potentially increase the price to ~£𝟏𝟓.𝟓𝟎, generating a 10% annual return against the current price of £8. This is 𝐞𝐱𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐢𝐧𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐠𝐫𝐨𝐰𝐭𝐡.

Finally, I believe France can be a great value source. A market share of 5% by 2030 (which I believe is achievable) would increase the price by £1.50 to £17. The future is uncertain, but I consider we shouldn’t neglect its 𝐨𝐩𝐭𝐢𝐨𝐧𝐚𝐥𝐢𝐭𝐲. If France goes well, the company can also start making its way to other European countries using its manufacturing assets in the UK.

Conclusion:

Unique business model granting solid Loyalty Effect from builders.

Industry with fragmented customers and suppliers.

The biggest and cheapest player in the industry by far with durable and widening competitive advantages.

Very efficient distribution system unmatchable by other players.

Great culture with decentralized decision-making process at depot level.

Great FCF generation.

Resilient business.

Good international optionality without the need of significant investments.

DISCLAIMER: This analysis is not an investment recommendation. Please, do your own due diligence.